JMMB Moneyline App Launched, Provides Complete Banking and Investing Experience

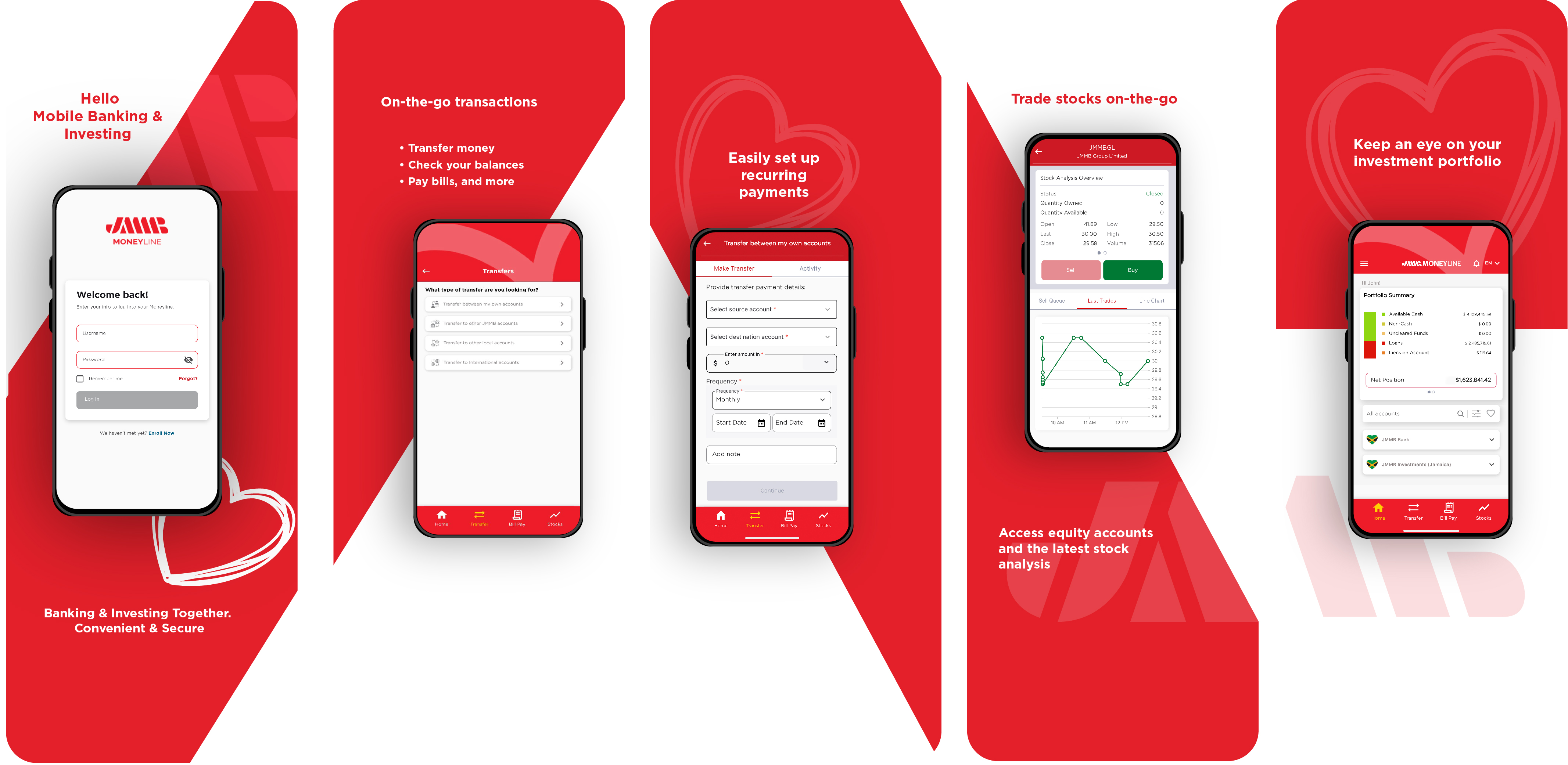

JMMB Group during its recent investor briefing (February 15), announced that its much-anticipated JMMB Moneyline app is now available for clients to download from the Google Play store and Apple Stores. The unique app gives JMMB clients a single and convenient interface to manage both their banking and investment portfolios at their fingertips.

Gifford Rankine, general manager, digital services at JMMB Group shared, “We are happy to deliver on our promise to clients, by providing a truly user-friendly mobile app that serves as a gateway for clients to effortlessly manage their finances, and improve our client experience.”

In giving further details on the app’s capabilities, Rankine outlined, “As the company aims to better cater to the needs of our clients and empower them to manage their financial lives in a seamless way, the app will allow them to pay bills effortlessly, wire funds locally and overseas, with the great feature of sharing confirmation receipts with recipients via email or WhatsApp, in addition managing their stock portfolio easily.” Adding, “We aim to continuously enhance the user experience by introducing new features and capabilities over time, with this in mind clients can look forward to doing more with the JMMB Moneyline app including: tracking their equities portfolio; manage their card, so that they can easily block or report their debit card outside of business operations; purchase IPOs and so much more.”

The JMMB Moneyline app is backed by state-of-the art security features including biometric and multi-factor authentication to safeguard users and the organization.

This latest move is in line with JMMB Group’s strategic direction to accelerate digital solutions to better meet the needs of clients and cater to their lifestyle and preferences. It comes on the heels of the launch of the JMMB Moneyline IPO platform in December, which allows non- JMMB clients to participate in public offers, including: initial public offerings (IPO), additional public offerings (APO), rights issues and preference share offers.

JMMB Group Looking to Roll-Out More Digital Solutions

Additionally, JMMB Money Transfer has rolled-out the full-scale launch of the JMMB Money Transfer Visa Prepaid card, which is designed to allow individuals in Jamaica to receive funds from friends and family overseas, from over 150 countries, with access to funds within minutes, 24/7, without the hassle of visiting a branch or agent location. The JMMB exec also revealed that several other digital solutions are set to come onboard by the end of the financial year, namely: online/digital onboarding that will be a game changer for the Group, allowing individuals to open an account from the comfort of their homes, in addition to enhancing the virtual assistant, Johanna, which is in its infancy stage and now allows clients to check account balances and money transfer status, via its website and WhatsApp number.

Rankine also shared that plans were afoot to further accelerate the Group’s digital transformation; although not sharing definitive timelines, he noted that the regional financial conglomerate is looking to build out its payment solutions, to include: the introduction of credit cards and Visa Business Debit cards in Jamaica; in addition to expanding its merchant services offerings (point-of-sale, mobile point-of-sale, card services) in Trinidad & Tobago; and rolling out debit cards in the Dominican Republic, subject to the necessary regulatory approval.

The acceleration of digital solutions is in keeping with the Group’s smart growth strategy, which is centred on utilizing capital more efficiently and diversifying its revenue streams, while meeting the needs of clients.

Keith Duncan, CEO of JMMB Group reassured clients that even as the company looks forward to more digital solutions to serve them better and improve operational efficiency, the client remains at the core of the business and as JMMB Group is looking to maintain its core value of love and best interest and exceptional client experience.