Moving from the JMMB Investments Save Smart Account to the JMMB Bank EzAccess or Smart Business Chequing Account

As part of our ongoing efforts to offer solutions that are in your best interest, JMMB Investments* will be retiring our Save Smart accounts. As a replacement, we are pleased to offer you a new JMMB Bank EzAccess or Smart Business chequing account, which will feature a secure chip-enabled VISA debit card.

WE’VE MADE IT EASY FOR YOU

This seamless transition will occur on January 13, 2020. Provided you have no objections, you are not required to

take any action. To expedite the process, your new card will be delivered by courier, to your mailing

address on record.

If you have any questions or would like to hear about alternative solutions, please call us, Monday to Sunday from

8:00 a.m. to midnight, on our dedicated helpline, at 876-704-3996, or 876-998-JMMB (5662). You may also contact us via email at savesmart@jmmb.com.

We appreciate your patience while we implement these improvements, which will give you greater access, safety, and convenience.

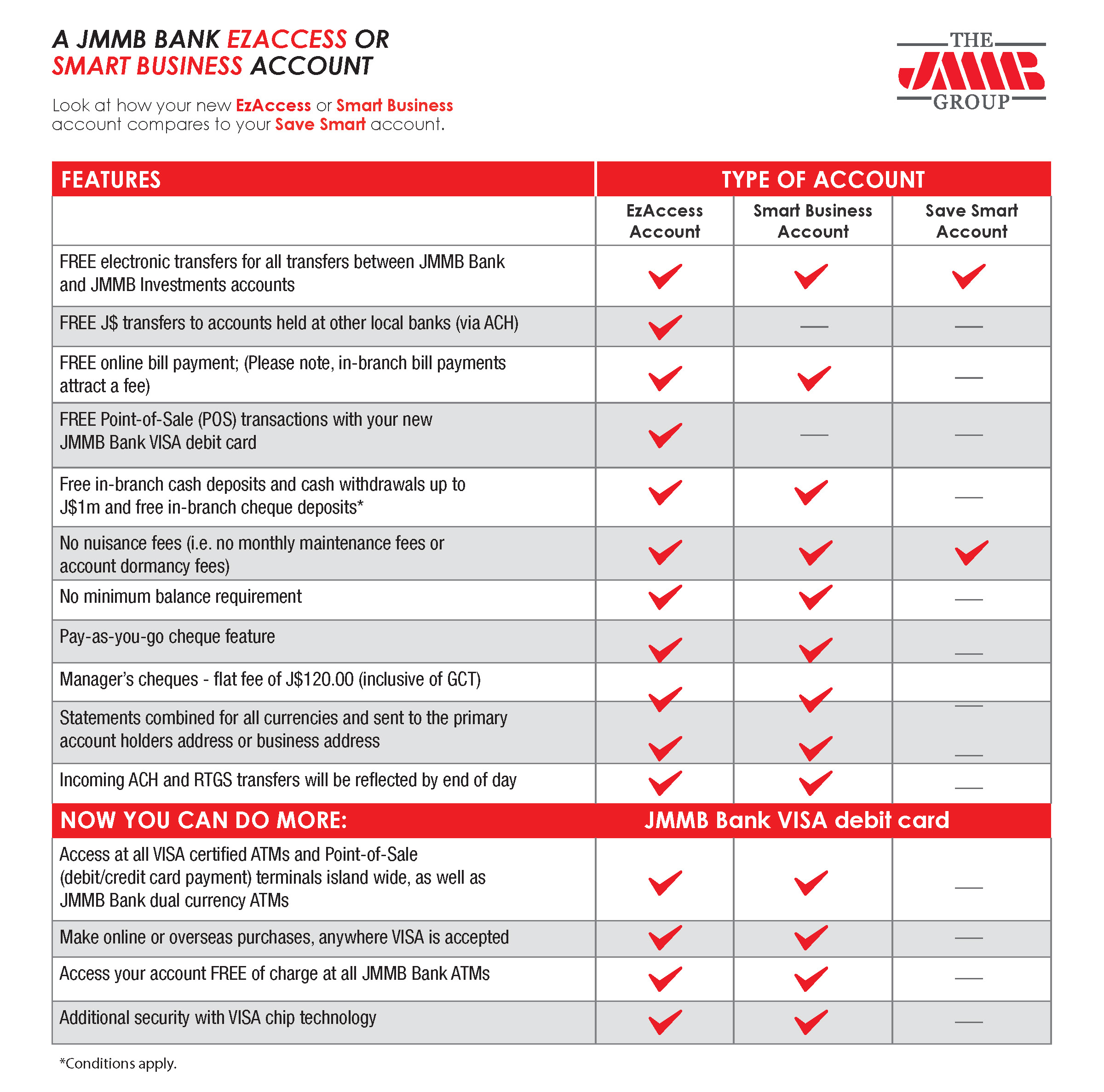

Get more with a JMMB Bank EzAccess or Smart Business Account

Frequently Asked Questions:

What is happening to my Save Smart account?

JMMB Investments will be retiring the Save Smart account. On January 13, 2020, we will close your

Save Smart account with us and place the funds at JMMB Bank. Depending on whether you operated your Save Smart account as a personal or business account, either a JMMB Bank EzAccess or Smart Business account will be opened in the same currency and with the same ownership rights as your Save Smart account. Both the EzAccess and Smart Business are transactional accounts, paying similar interest rates as Save Smart.

As we are striving to make this process as easy and seamless as possible, you are not required to take any steps if you have no objection to your funds being placed at JMMB Bank. However, if you wish to give us other instructions, you may contact us by January 8, 2020. Call us at a dedicated helpline, 876-704-3996, Monday to Sunday from 8:00 a.m. to Midnight; our Client Care Centre at 876-998-JMMB (5662) or email us at savesmart@jmmb.com.

I have several Save Smart accounts. Will all my accounts be combined into one?

if they have the same ownership rights. For each existing Save Smart account, a new JMMB Bank account will be created. If you prefer that all or some of your Save Smart accounts with the same currency and ownership rights are combined, you may let us know by January 8, 2020 and we would be happy to do so.

Will my EMMA account(s) be affected?

JMMB Investments will continue to offer and maintain EMMA accounts (for stocks). Please note your EMMA account(s) will not be

accessible with your new JMMB Bank VISA debit card, however, you can enjoy convenient access from our online portal, Moneyline at any time. If this access is important to you, please speak with us so that we can determine the best solution for you based on your specific needs.

Will my JMMB Investments ETM card still work?

We have expanded our service offerings to give you even more access. All existing cardholders will receive a new JMMB Bank VISA debit card, linked to their new JMMB Bank account(s). This new card will give you access to both the VISA network, as well as JMMB Bank ATMs. JMMB Bank’s dual currency ATM’s will be available as at January 13, 2020. You should go ahead and discard your old JMMB Investments ETM card, at that time. Please note that your old card will no longer work after January 13, 2020, as your Save Smart account will no longer exist.

What are the benefits and features of the JMMB Bank EzAccess and Smart Business accounts?

a) FREE electronic transfers for all transfers between JMMB Bank and JMMB Investments accounts, and for J$ transfers from your JMMB Bank EzAccess account to accounts held at other local banks (via ACH);

b) FREE online bill payment; (please note, in-branch bill payments attract a fee);

c) FREE Point-of-Sale (POS) transactions with your new JMMB Bank VISA debit card, when accessing your JMMB Bank EzAccess account(s)

d) No nuisance fees (i.e. no monthly maintenance fees or account dormancy fees);

e) No minimum balance requirement;

f) Pay-as-you-go cheque feature;

g) Interest is calculated daily and paid monthly; and

h) Free in-branch cash deposits and cash withdrawals up to J$1m and free in-branch cheque deposits.

(Please note a cash handling fee is applicable for deposits in excess of J$1m, as well as for foreign exchange cash deposits in excess of 500 foreign exchange units per business day per account [USD, GBP, EUR & CAD], subject to a maximum of 5,000 foreign exchange units for individual accounts per calendar month and 15,000 foreign exchange units for corporate accounts per calendar month.)

Will I still get my statements?

Yes. Please note there is a difference with the statement distribution process for your new JMMB Bank account(s). The primary account holder will receive a single statement showing all account(s), for all currencies, where the joint account holders are the same.

The statement will be sent to the primary account holder’s mailing address.

For example:

• John Brown [primary account holder] and Mary Smith share three JMMB Bank accounts.

• John Brown and Peter Thomas share one account.

• John Brown = 1 statement for the 3 accounts with Mary Smith + 1 statement for 1 account shared with Peter Thomas.

What will my new JMMB Bank VISA debit card give me access to?

Once activated, your new card will be ready for use on or after January 13, 2020.

• You can then use it at all VISA certified ATMs and Point-of-Sale (debit/credit card payment) terminals island wide, as well as JMMB Bank dual currency ATMs. Visit our website jm.jmmb.com/our-services, for a list of the JMMB Bank’s dual currency ATM locations and services.

• You can also use it for online or overseas purchases, anywhere VISA is accepted.

• With your new JMMB Bank VISA debit card, you may access any J$ or US$ account(s) linked to your new card.

This means that;

i. Save Smart account holders who had Save Smart accounts linked to their ETM card will now be able to access their new JMMB Bank

account(s), which replaces their Save Smart account(s), with this new JMMB Bank VISA debit card.

ii. Similarly, Save Smart clients also holding JMMB Bank account(s) previously linked to a JMMB Bank debit card, will also be able to access

those accounts with this new JMMB Bank VISA debit card.

iii. It is important to note that only one primary chequing and one primary savings account will be accessible from your JMMB Bank VISA debit card, on the VISA network. So, even though multiple accounts may be linked, at a VISA terminal only the primary accounts are accessible. (See definition of primary accounts below.)

What is a primary account?

Your primary account, refers to the main chequing and savings account(s), either J$ or US$, that will be accessible via your new JMMB Bank VISA debit card, at all VISA certified ATMs and Point-of-Sale (debit/credit card payment) terminals islandwide. So, if you use the VISA network, only your primary account(s) will be accessible.

Please note, for online or quick cash transactions (i.e. pre-selected ATM withdrawal amounts), you can only have one primary account. If you have only one account linked to your JMMB Bank VISA debit card (either chequing or savings), that account will default as your primary account have both a chequing and savings account linked to your JMMB Bank VISA debit card, your chequing account will default as your primary account accessible online.

I have a loan with JMMB Investments secured by my Save Smart account. Will I be required to sign new loan documents with JMMB Bank?

No. You will not be required to complete new loan documents. The funds in your existing Save Smart account(s), used to secure your outstanding loan, will be transferred to a new Smart Investor account(s) at JMMB investments with the same currency and ownership rights as your existing Save Smart account(s). A new EzAccess chequing account, which features a secure chip-enabled VISA debit card, will also be opened at JMMB Bank with the same currency and ownership rights as your existing Save Smart account(s). All standing orders on your Save Smart account(s) will be transferred to this new account. On January 13, 2019 if there is any balance in excess of the amount required to secure your outstanding loan, this will be transferred to your new EzAccess account(s) after which your Save Smart account(s) will be closed. You will be required to visit a branch to request your new Visa debit card which you can start using on January 13, 2020.

Read our full Frequently Asked Questions