Your Investment Mate: Stocks or Unit Trusts?

Do you want the satisfaction of seeing your money multiply? The stock market has been booming, in fact, the Jamaica Stock Exchange (JSE) has been ranked as the best performing stock exchange in the world in 2018. Initial Public Offerings (IPOs) have been issued in quick succession, with three (3) IPOs coming to market since the start of the year. Stocks have become the ‘money magnets’. However, should you purchase individual stocks or should you buy into a unit trust fund that is largely invested in several stocks?

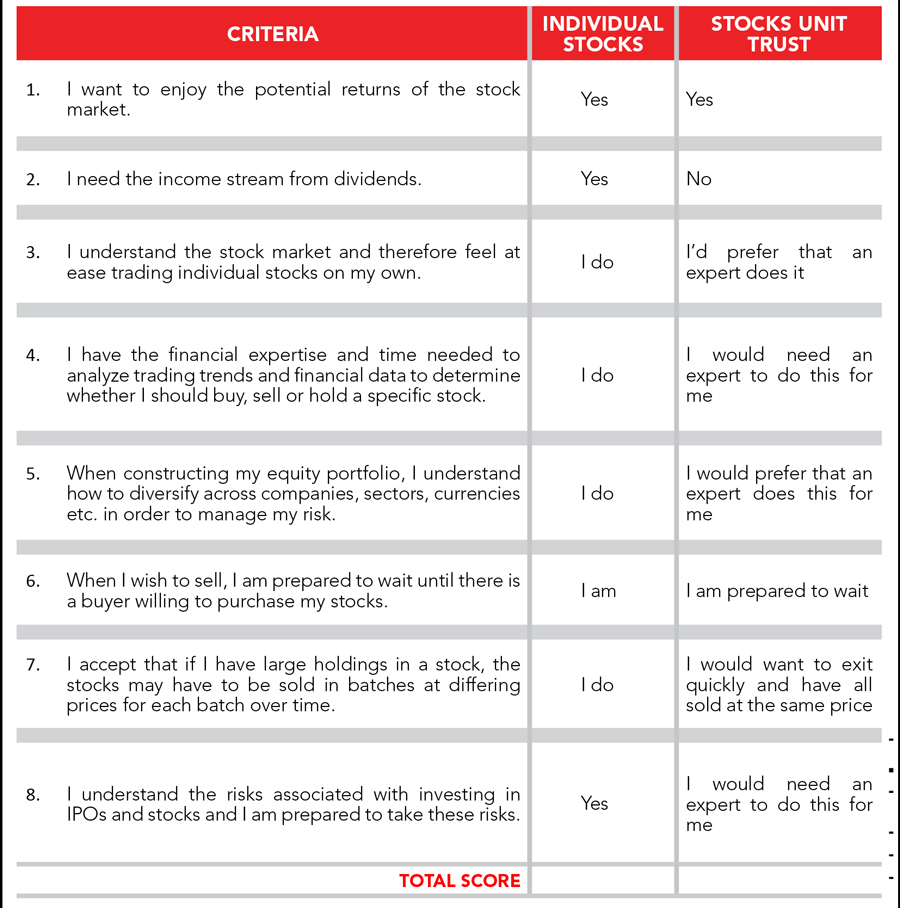

Here is a simple quiz to help you determine which option is a better ‘investment mate’. Simply circle the answer which matches you and total it, then compare the responses to determine which investment option is best for you. Please note that each answer is worth one (1) point.

What is your score telling you? Which ‘investment mate’ is better suited to you, individual stocks, a unit trust or both? A simple tally of your score, will indicate which is best suited for you.

If individual stocks are your choice, experience the ease of buying and/or selling stocks online, using Moneyline, including the TransJamaican Highway Limited IPO. Get more details on the latest IPO and how to apply via Moneyline at https://jm.jmmb.com/TJH.

However, if a unit trust fund is more appropriate, the JMMB’s Income and Growth Unit Trust which earned 22.48%* from Feb 5, 2019 to Feb 5, 2020 may be ideal for you. Get more details about our unit trusts at https://jm.jmmb.com/jmmb-funds-unit-trust.

*JMMB Funds are managed by JMMB Fund Managers Limited. Past performance of unit trusts and mutual funds is not an indication of future returns.

Written by: Michelle Sinclair-Doyley, manager, client financial education, JMMB