Do You Have a Goal or Do You Want to Make Money?

What are your financial goals? Neither Angie nor her friend Brian could answer, but they were sure they wanted to “make money.” “Guys, if you were going to bake, wouldn’t you need to know what you were going to bake, in order to know the ingredients, measurements and method of preparation?” I asked. “Of course! It could be the difference between a cake and toto!” Angie chuckled. Well it’s the same with your money.

1. IDENTIFY WHAT YOU WANT – Ask yourself, “How do I define success? Is it owning a big house and fancy car and/or being able to take care of aging relatives? Go ahead and think/visualize/dream what you want in the future.

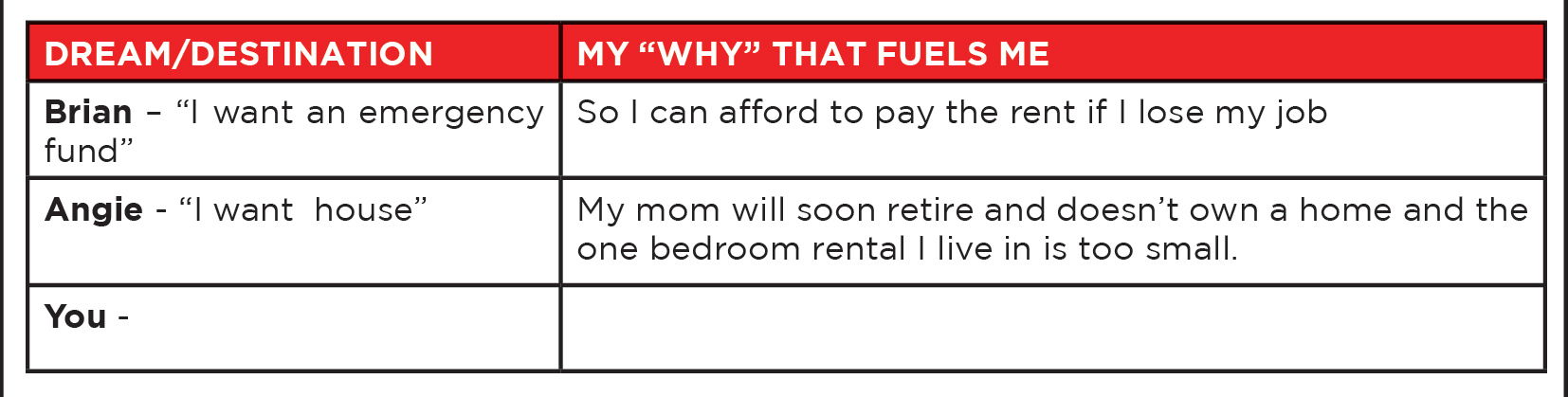

2. FIND YOUR INSPIRATION - I continued, “If achieving your dream is your destination, then your “why” is your motivation.” Angie jumped in, “Yes, I was so tired but baked and decorated a dream cake for my son. My motivation was the big smile, I knew I would get at the end.” “So what would you want to achieve financially and what would motivate you?” I asked. These are their responses.

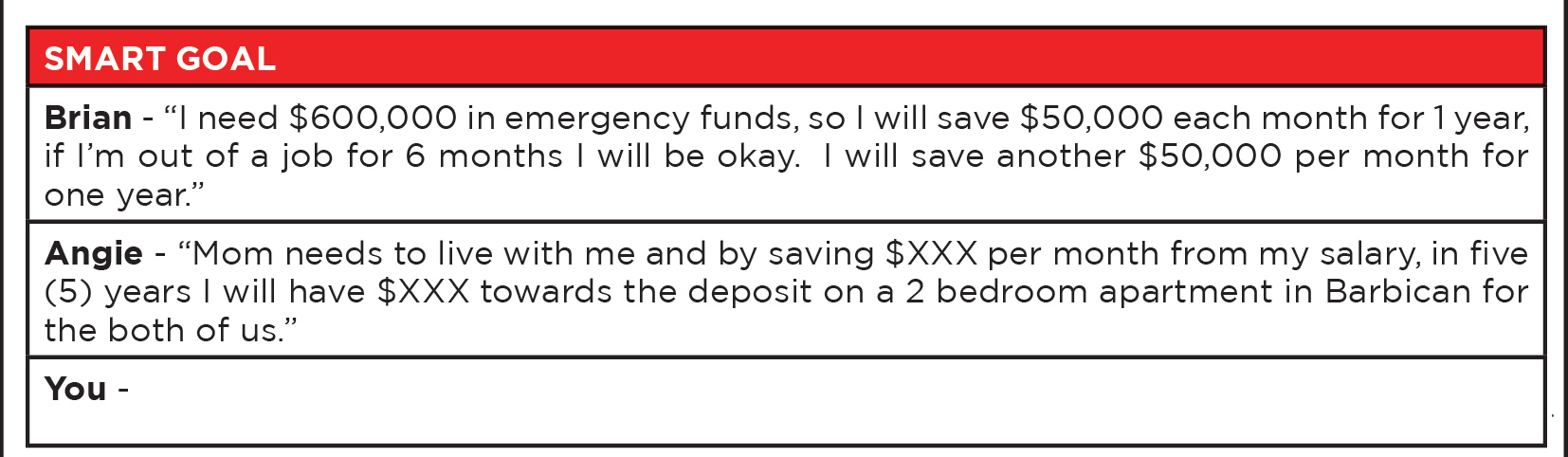

FROM INSPIRATION TO ACTION - Dreams inspire. However, actionable goals will change the course of our lives, so make your goals Specific, Measurable, Achievable, Realistic and Time-Bound (SMART).

3. DIFFERENT GOALS AND DIFFERENT TIMELINES REQUIRE DIFFERENT TREATMENTS - “Could we drop some money on the stock market and make it double in a couple of months?” Brian asked. I interjected quickly “Ordinary stocks don’t provide a guaranteed return! The potential risk and returns are high. If in two months you lose your job, and simultaneously realize your stocks are valued less you would be upset. So it is best to keep your emergency funds, which you may made need in the short-term, in a savings account like a JMMB Bonus Saver.”

Stocks are more appropriate for long-term goals, like Angie’s five (5) year goal of owning her home, since there would be time to rebound from short-term losses. However, if you do not have the time or expertise to trade stocks, the JMMB Income and Growth Unit Trust, which earned 219% over a five (5) year period, ending June 30, 2019, would be ideal.

What is the most appropriate savings or investment to achieve your goal? Give us a call on 876-998-5662 and we will partner with you to achieve your financial goal.

- Written by: Michelle Sinclair-Doyley

Manager, Client Financial Education, JMMB Group