JMMB Elevate 3.0 Encourages Jamaicans to Re-imagine Goal Achievement

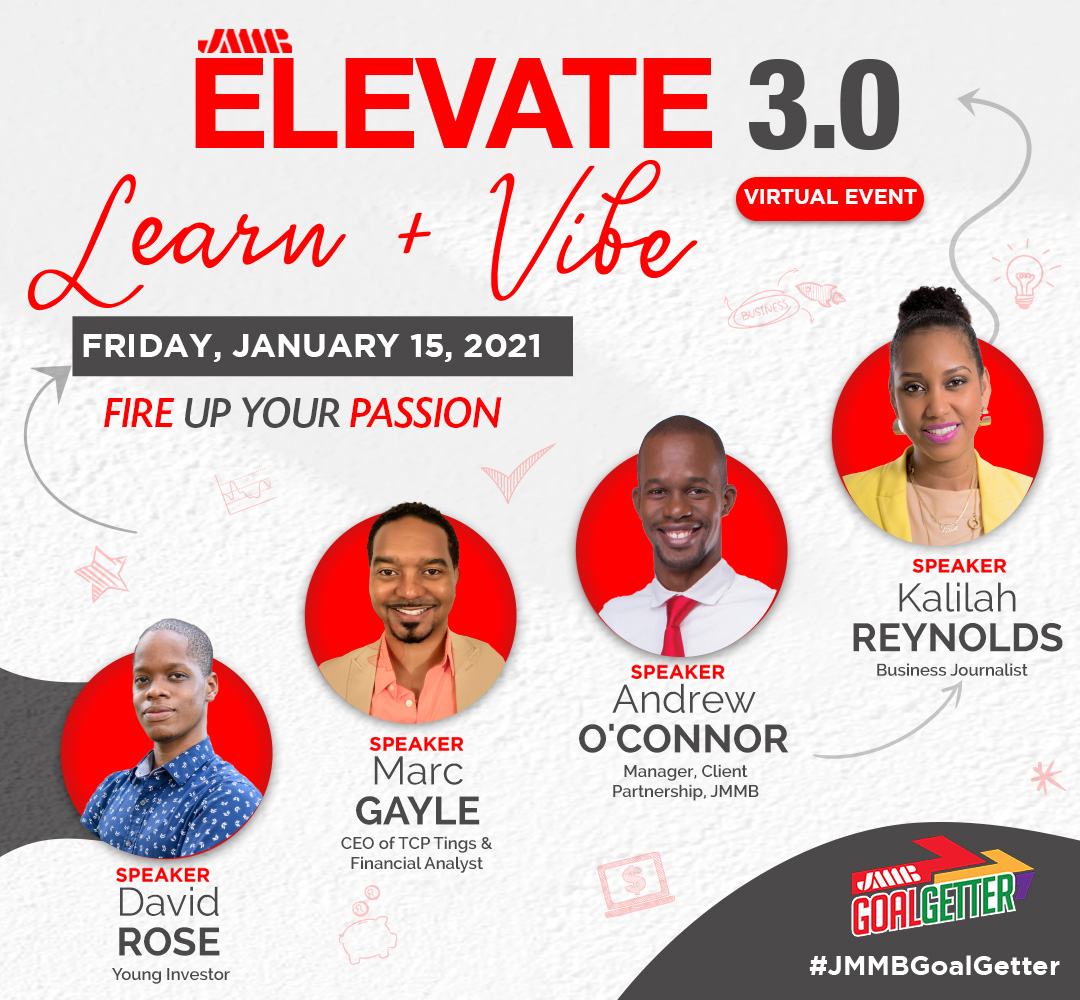

With the hope of an improved 2021 high on the minds of most Jamaicans; JMMB Group boldly declared the new year as one for claiming goal achievement at the kick-off of its two-day, signature financial empowerment event, JMMB Elevate 3.0 on Friday, January 15.

Building on the momentum from its previous stagings, day-one of the exclusively virtual session dubbed, ‘JMMB Learn & Vibe’ delivered a unique, digital experience that saw over 500 seasoned and new financial go-getters navigating the Spotme Conference platform to learn more about how to adapt in the changing financial landscape, while enjoying the good vibes built by DJ CopperShaun of Coppershot Sound, in the opening segment.

Anchored by the Conference's main theme, Fire Up Your Passion and hosted by Kerry-Ann Stimpson, chief marketing officer at JMMB Group, the Learn & Vibe discussion segment explored the dramatic and impactful elements at play when managing personal finances and explored financial opportunities.

“Having gone through 2020, and in the midst of every crisis or challenge, there is always an opportunity and hope for a brighter tomorrow. That is the key takeaway that we want to bring across. When we educate and keep ourselves informed, we keep hope alive for our financial well-being, and for the people around us”, explained Stimpson.

.jpg) Drawing from the Charles Dickens novel, “A Tale of Two Cities” for reference, Kalilah Reynolds, panel presenter and CEO, Kalilah Reynolds Media explored the local, regional and international news items that impacted investors that ultimately led to the tumult that was 2020. Most noteworthy of the events of 2020 that were highlighted are: Digicel Group Ltd bankruptcy; elections in the region and beyond, and the aftermath in countries like Guyana, USA and Jamaica; Barita’s additional public offering (APO) as the first company locally to go to market successfully in the pandemic and the economic fallout during the country’s lockdown.

Drawing from the Charles Dickens novel, “A Tale of Two Cities” for reference, Kalilah Reynolds, panel presenter and CEO, Kalilah Reynolds Media explored the local, regional and international news items that impacted investors that ultimately led to the tumult that was 2020. Most noteworthy of the events of 2020 that were highlighted are: Digicel Group Ltd bankruptcy; elections in the region and beyond, and the aftermath in countries like Guyana, USA and Jamaica; Barita’s additional public offering (APO) as the first company locally to go to market successfully in the pandemic and the economic fallout during the country’s lockdown.

While noting that the next phase in the finance and personal health journey for many Jamaicans would be vastly different for the next generation, in light of the global pandemic, Reynolds reassured participants that there were many opportunities for growth, and a light at the end of the tunnel.

“Coming out of 2020 we have seen digital transformation speeding up in a big way. A lot of companies are finally embracing digital technology, many who were refusing to go online before have suddenly realized that digital is the future, whether through e-commerce or websites. This transformation is bound to have an impact on the post-COVID world,” she continued, “We also saw commercial banks closing branches and moving to more digital experiences. Despite some of the criticism I believe this is a good thing as persons who are reluctant to try online banking are now finally embracing it.”

Reynolds further noted that roughly 3,586 new companies were registered between January to November 2020.

With the focus of the event set on encouraging and empowering individuals to be more intentional about their financial achievement, ‘JMMB Learn & Vibe’ rounded out the evening with a panel discussion led by returning presenters David Rose, young investor and business writer and Marc Gayle, financial analyst and entrepreneur alongside JMMB’s financial expert, Andrew O’Connor, client partnership manager at the Portmore branch.

At the forefront of the discussions was the necessity and relevance of balancing the zest for increasing financial wealth with financial education and personal financial responsibility. Citing personal experiences, O’Connor cautioned young investors to learn from their mistakes get advice from an experienced and licensed financial advisor

.jpg) “I learnt at a very young age that investing and emotions don't mix, it is almost like oil and water. When you are investing towards a particular goal, at times your emotions can push you to make incorrect or untimely decisions. (Instead) do your own homework, by reading and digging further into the company you are considering investing in, you may find new information to guide your decision making. I would also caution persons to not shy away from risk,” stated O’Connor.

“I learnt at a very young age that investing and emotions don't mix, it is almost like oil and water. When you are investing towards a particular goal, at times your emotions can push you to make incorrect or untimely decisions. (Instead) do your own homework, by reading and digging further into the company you are considering investing in, you may find new information to guide your decision making. I would also caution persons to not shy away from risk,” stated O’Connor.

He went further, “Many times, persons want ‘risk-free’ investments. While there isn't any investment that is (completely) ‘risk-free’ I would say, don’t be afraid of it (risk), embrace it. Make sure you understand what the risk with any investment and try to be comfortable with it. When you do this you will be putting yourself in a better position to be able to achieve some of your financial goals in the long-term.” The financial advisor also implored investors to understand their own investment style, goals and risk tolerance and use that as a guide versus making emotional decisions and ‘herd-like’ investment decisions.

Echoing similar sentiments, Marc Gayle added, “Investing in companies you love thoroughly is important. However, it is not enough to just like the company's brand or be a consumer of their products. You must understand their financial health. A key tool in managing the risk, Andrew, mentioned is by arming ourselves with knowledge.”

“Attending sessions like JMMB Elevate 3.0 and investing in education through courses to learn how to read financial statements and doing proper analysis of the company you are considering, are ways you can empower yourself before investing in bonds or equity” he explained. David Rose also emphasized the need to research and as a young investor to use mistakes learnt along the way, as lessons in refining your investment strategy.

JMMB Elevate 3.0 continued on Saturday, January 16 at 10 am with another impressive round of discussion, fireside chat with local experts who will challenge individuals to take action and replace fear; with the power of now. International headliners, John Henry, real estate developer, entrepreneur, and investor and Stacey Flowers, entrepreneur and motivational speaker, closed out the mainstage with the charge to participants to move into action. In addition to the video stream and speaker interaction, the robust app supported icebreakers and games, resources, interactive goal planning sessions and other features that were well received.