JMMB Elevate Demystifies & Debunks the Emergency Fund

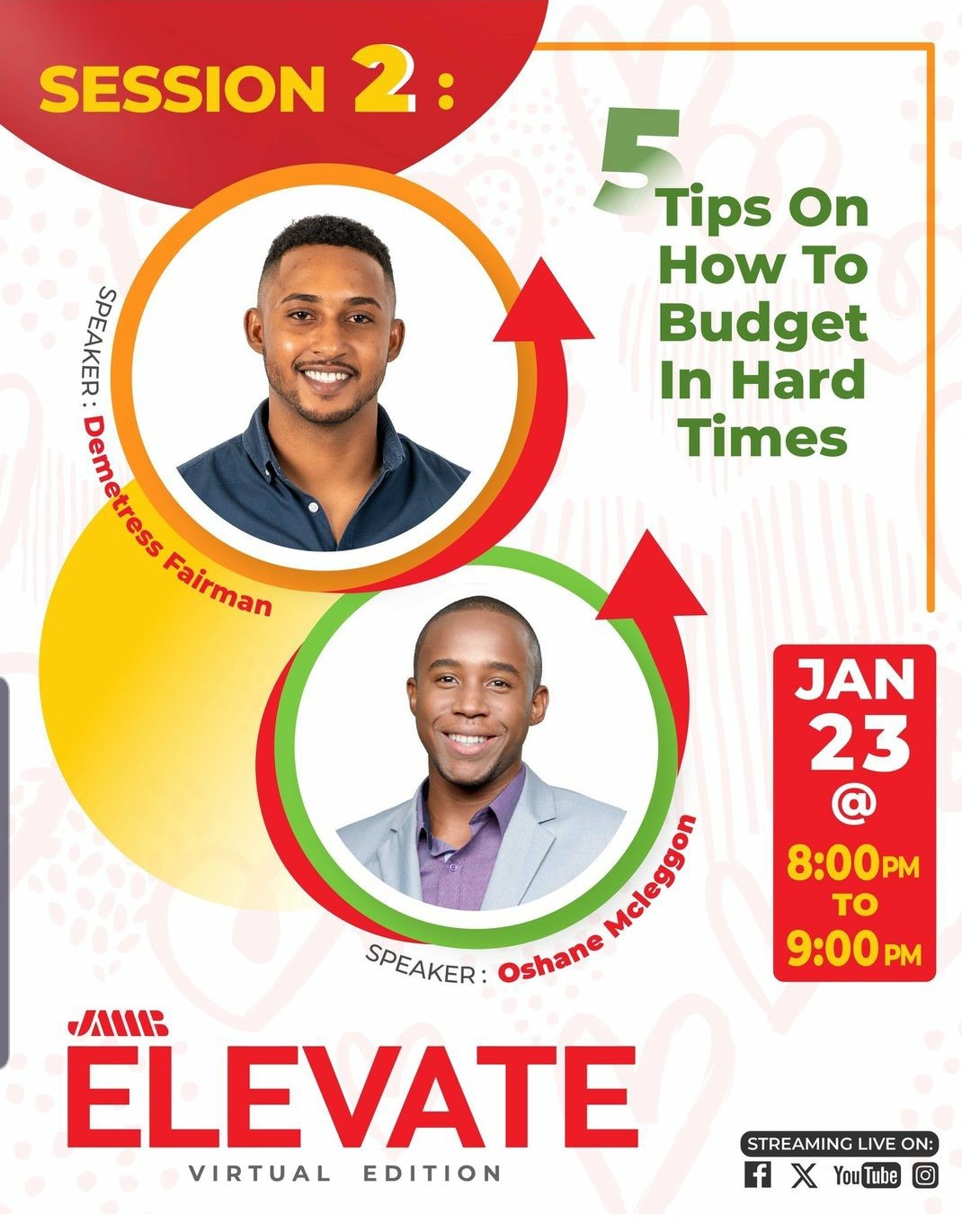

In an era marked by economic uncertainties and unexpected challenges, the concept of an emergency fund has been hailed as a financial safety net, by many financial experts. However, misconceptions, myths and even controversy surrounds what is seen by many financial gurus as an essential financial tool, therefore hindering some individuals from fully grasping its true potential. During the recent JMMB Elevate 6.0 series, while exploring the topic, ‘Budgeting in Hard Economic Times,’ Oshane McLeggon, financial solutions manager at JMMB alongside Demetress Fairman, financial education content creator underscored the importance of budgeting and having an emergency fund as keys to building a solid financial foundation.

What is an emergency fund?

McLeggon outlined, “Simply put, an emergency fund is money that you have put aside for a ‘rainy day’, it is for those unexpected expenses, where you may meet in an accident (and some expenses are not covered by your insurance), in case of job loss, etc.” Adding that one’s emergency funds are expected to cover unexpected essentials not wants. The financial advisor went further in the session to demystify and debunk a few myths, which are outlined here:

Myth 1: “I don’t need an emergency fund.”

Coming right out the gate, the JMMB financial solutions manager, dispelled the myth that an emergency fund was unnecessary, instead he championed it as a cornerstone of one’s financial management framework. He outlined that in times of crisis or financial mishap one’s emergency fund provides a bridge ‘across troubled financial waters’ and gives peace of mind, as a buffer is in place. McLeggon outlined that by relying solely on credit cards or one’s investments in the case of a financial emergency can lead to a cycle of debt or further financial loss.

Instead the financial advisor shared, “The rule of thumb is to have 3-6 months of expenses in your emergency fund and it can be more in these harsh economic times, of course each person’s situation can be unique and so speak with your advisor (to align on the target amount based on your individual circumstances).”

Myth 2: “An emergency fund is simply hoarding cash, and provides no returns.”

In building on h is first point, McLeggon opined, “Don’t look at it (your emergency fund) as hoarding cash, it is a risk management strategy.” He therefore encouraged individuals to view their emergency fund as part of their overall portfolio that consists of several assets namely: cash, which includes their emergency fund and other investments such as bonds, real estate, stocks and other alternate investments. Against this background he noted, “I never recommend that you put your emergency fund in stocks and that’s primarily because stocks are long-term investments, and you (also) have to account for the fees that you are paying when you are buying or selling that stock. Additionally, the price of that stock may go down and you have to sell in the case of an emergency, which means that you will make a loss.”

is first point, McLeggon opined, “Don’t look at it (your emergency fund) as hoarding cash, it is a risk management strategy.” He therefore encouraged individuals to view their emergency fund as part of their overall portfolio that consists of several assets namely: cash, which includes their emergency fund and other investments such as bonds, real estate, stocks and other alternate investments. Against this background he noted, “I never recommend that you put your emergency fund in stocks and that’s primarily because stocks are long-term investments, and you (also) have to account for the fees that you are paying when you are buying or selling that stock. Additionally, the price of that stock may go down and you have to sell in the case of an emergency, which means that you will make a loss.”

Instead, individuals can take advantage of the high interest environment and reap returns, while not compromising the liquidity of their emergency fund. McLeggon pointed to high yielding saving accounts such as the JMMB Bonus Saver and even a money market instrument for a portion of your emergency fund, based on the individual’s overall financial plan and unique circumstances. As such individuals can have the best of both worlds, benefitting from risk adjusted returns, while being financially prepared. He however cautioned, “ensure your emergency fund is not linked to your (debit) card, instead transfer funds to gain access (to cash) if necessary,” in order to avoid the temptation of dipping into these funds.

Myth 3: “You don’t need an emergency fund to start investing.”

Dubbing the emergency fund, a critical foundation to build one’s investment strategy, the financial advisor urged investors to start building their emergency fund before investing, as this will protect their overall portfolio. “If you start out with investing in the stock market and an emergency hits you, it is highly likely that you will make a loss, because you have to sell your (assets),” he said. Taking a practical approach, he noted that although 3-6 months of expenses is ideal before starting, individuals can start with at least a month or two, and as they build their wealth, they should bolster their emergency funds.

During the hour-long discussion, Demetress Fairman also shared pointers to support individuals to elevate their finances and achieve their goals. Here are a few takeaways he shared that can help persons to level up their financial management, build their emergency fund and ensure they have a solid financial foundation.

During the hour-long discussion, Demetress Fairman also shared pointers to support individuals to elevate their finances and achieve their goals. Here are a few takeaways he shared that can help persons to level up their financial management, build their emergency fund and ensure they have a solid financial foundation.

1. Shift your mindset to understand your needs vs wants. “Needs sustain your life, while wants sustain your lifestyle,” after determining these you can reduce your expenses by spending less on your wants. Therefore, determine your priorities and align your spend.

2. Be disciplined: Avoid impulse spending and choose cheaper and available options, so that you can better manage your expenses.

3. Increase your income by investing in skill-building. He pointed to side hustles, freelancing and passive income sources such as dividends to supplement your income. “We have to invest in ourselves in order to make money, and not simply (think) which stock or job is going to give me a lot of money, if we invest in ourselves we can earn that additional money”. He therefore urged individuals to “find something that you are interested in, it doesn’t have to be one specific job, (identify something that) aligns with you and then not just budget money but budget time...to do other things outside of work (and earn more).” Oshane McLeggon chimed in adding that even as individuals upskill they can also use their transferable skills to pursue a side hustle and generate and/or diversify their income.

Debunking and demystifying the emergency fund and underscoring the importance of budgeting, is in keeping with the objective of JMMB 6.0 to empower and inspire individuals to take actionable steps to achieve their goals and level up their ‘money game,’ noted Kerry-Ann Stimpson, chief marketing officer at JMMB Group. Financial security is not a privilege but a proactive choice that starts with informed decision-making.