Christmas Bonus: ‘Live Big’ Now OR ‘Achieve Big’ Later

“Wow! I earned 175%* on my investment. My Christmas Bonus is now almost triple” Dwayne was ecstatic that he had curbed the urge to splurge and ’live big,’ when he got a bonus five (5) years ago. He had instead invested J$100,000 (including his bonus) and now, he has J$275,000. “Cho man! If I had invested every bonus for the last five years, I could have a lump sum towards my down payment on my apartment. That would be achieving big,” he thought to himself.

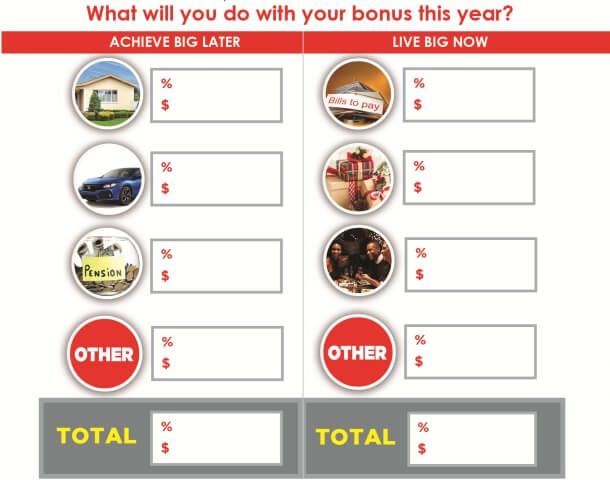

Which financial goal could your bonus help you to attain? What percentage of your bonus would you like to invest towards making your financial dreams become a reality vs. enjoying the ‘spoils’ now? Here is a secret. Planning ahead of time will increase the likelihood of you deciding where your bonus goes – whether you invest in “achieving big” in the future vs “living big” now.

Please complete this exercise today to determine the percentages you will invest vs spend. Later when you have your bonus in hand; you can update it with the in the actual amount.

If, like Dwayne, you choose to invest towards your dreams through the JMMB Income and Growth unit trust fund, you would have started to build your own stock portfolio, managed by JMMB, This would allow you to reap the benefits of investing in stocks even with limited time and expertise to trade. Although the past returns are not a guarantee of future returns, JMMB’s track record of managing its stock portfolios has given great returns, just ask Dwayne.

Do you want to ‘live big’ in the future? Plan ahead for your Christmas bonus with JMMB. Let us help you to determine whether the Income and Growth or another financial solution is just right for you, based on your goal. Click here to schedule an appointment with on of our advisors.

*The returns stated for the JMMB Income and Growth is for the period, September 30, 2013 to September 30, 2018, with no withdrawals being made during that period.

Written by: Michelle Sinclair Doyley, Manager, Client Financial Education, JMMB Group